Rendering Knowledge Graphs for Human Consumption

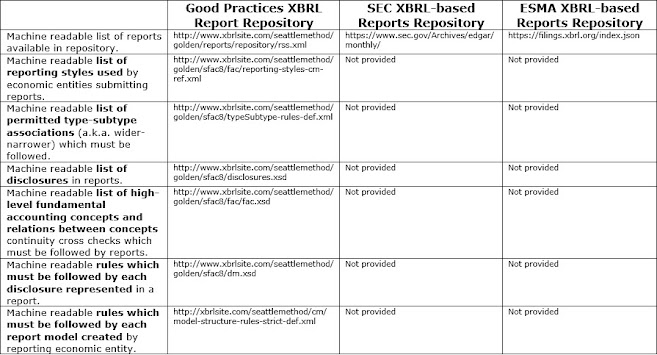

In the article, What is a Knowledge Graph? , IBM describes knowledge graphs as such: A knowledge graph, also known as a semantic network, represents a network of real-world entities—i.e. objects, events, situations, or concepts—and illustrates the relationship between them. This information is usually stored in a graph database and visualized as a graph structure , prompting the term knowledge “graph.” Note the highlighted and bold text "...and visualized as a graph structure...". That is a true statement about the visualization of a knowledge graph. A graph view is a general way to view a graph of information. But that "general way" is only "generally useful". You can also view knowledge graphs in specialized ways . For example, this is a knowledge graph of a financial report: ( click here for a larger view ) That same report might look something like the following in say Neo4j: Both versions of the rendering of a knowledge graph have their uses. T...