The Story of Our New Language

(UPDATE: President Biden did, in fact, sign the Financial Data and Transparency Act into law on December 23, 2022 as part of the National Defense Authorization Act. Here is the actual text of the bill that was passed.)

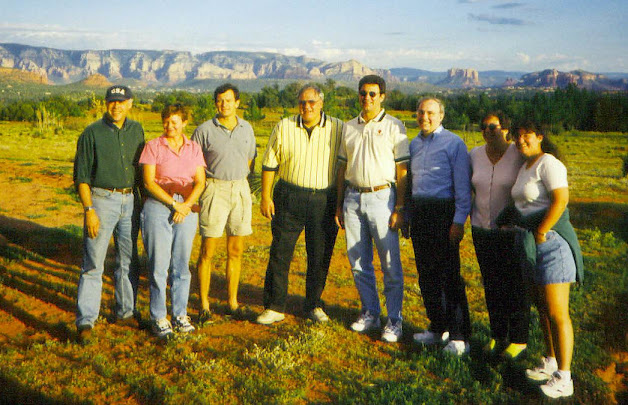

In July of 1998 a meeting of the AICPA High Tech Task Force took place in Sedona, Arizona. The purpose of the meeting was to discuss an idea that I had to represent financial reports in machine readable form using the Extensible Markup Language (XML) which was published by the W3C earlier that year.

At the meeting were (pictured below in order) John Woodburn (The Woodburn Group), Dianne Spencer (Deloitte & Touche LLP), Charles Hoffman (Knight, Vale and Gregory), Mike Harnish (Dickinson Wright et al), Wayne Harding (Great Plains Software), Chris Reimel (N.J. Department of Labor), Barbara Vigilante (AICPA), and Karen Waller (AICPA).

As a result of that meeting, the industry standard Extensible Business Reporting Language (XBRL) was created and XBRL International was established as its governing body. The story of how XBRL was created is chronicled in this document published by the American Institute of Certified Public Accountants (AICPA), The Story of Our New Language.

Add about 10 more to that list from the United States of America. Yesterday, the Financial Data Transparency Act (FDTA) was passed by the U.S. Congress as part of the National Defense Authorization Act for Fiscal Year 2023. See page 2445 for Title LVIII Financial Data and Transparency and page 2462 Data Transparency Relating to Municipal Securities.

What this seems to mean is that the Federal Government is going all in on digital machine readable financial reporting. The FDTA says that for all "covered agencies" the "financial entities the jurisdiction of the covered agency" will be required to report standards based machine readable information. While all these groups of entities are not covered by this act; this seems to mean that the following will eventually be covered:

- About 7,000 public companies that are regulated by the Securities and Exchange Commission. (already in place)

- About 110,000 state and local governments that issue municipal securities and it seems will be regulated by the Securities and Exchange Commission; they currently report to the U.S. Census Bureau.

- About 6,000 national banks regulated by the FDIC (already in place).

- About 5,000 credit unions regulated by the National Credit Union Administration.

- About 350,000 not-for-profit organizations that receive grants from the Federal government and report information to the Treasury Department.

- About 850,000 pension plans that report to the Department of Labor. (does not seem to be covered by this current law)

- Unknown amount of entities that report to the Office of the Comptroller of the Currency.

- Unknown amount of entities that report to the Bureau of Consumer Financial Protection.

- Unknown amount of entities that report to the Federal Reserve.

- Unknown amount of entities that report to the Federal Housing Finance Authority.

In addition, I predict that private equity will also be reporting using machine readable digital reports sometime in the near future. The paper, An Economic Case for Transparency in Private Equity: Data Science, Interest Alignment and Organic Finance, suggests this. And finally, I predict that the approximately 25 million small and medium sized entities in the United States will be creating digital financial reports within 5 to 10 years, perhaps less.

Digital financial reporting is a once in 500 years change. This change, a paradigm shift really, is happening now and it was fun being part of making this a reality.

For more information about XBRL:

- The History and Evolution of XBRL

- FASB About XBRL

- IFRS Foundation Accounting Taxonomy

- AICPA's explanation of XBRL.

- Journal of Accountancy Article, XBRL: Its Unstoppable

- XBRL International

- How XBRL Works video

- Mastering XBRL-based Digital Financial Reporting

- XBRL Implementations Around the World

- More and Better Uses Ahead for Governments’ Financial Data

- An Economic Case for Transparency in Private Equity

- History of XBRL

- Today, a search on "XBRL" yields 7,870,000 hits on Refseek

- Comment Letter to SEC (1998) suggesting that they consider using XML as a filing format for EDGAR filings.

- Download XBRL for Dummies PDF

- Vision: Electronic Health Records (EHR) Oriented Knowledge Graph System

- What Can you Do with an Idea?

- New law on data transparency will improve governance

- Financial Data Transparency Act of 2022

- Treasury's Bold Vision: Entire Spending Life Cycle

- GREAT Act

- International Organization of Securities Commissions (IOSCO)

- Australian Securities and Investments Commission (ASIC)

- United Kingdom's Financial Conduct Authority (FCA)

- Canadian Securities Administrators (CSA)

- Japan Financial Services Agency (FSA)

- China Securities Regulatory Commission (CSRC)

- Brazil's Securities and Exchange Commission (CVM)

- India's Ministry of Corporate Affairs (MCA)

- South Africa's Companies and Intellectual Property Commission (CIPC)

- Russia's Federal Financial Markets Service (FFMS)

- Mexico's National Banking and Securities Commission (CNBV)

- Turkey's Capital Markets Board (CMB)

- Saudi Arabia's Capital Market Authority (CMA)

- United Arab Emirates' Securities and Commodities Authority (SCA)

- Indonesia's Financial Services Authority (OJK)

- Vietnam's State Securities Commission (SSC)

- Thailand's Securities and Exchange Commission (SEC)

- Philippines' Securities and Exchange Commission (SEC)

- (Other projects, list of 213 projects provided by XBRL International at the time of this writing)

Comments

Post a Comment