World's First Standards Based Expert System for Creating Financial Reports

Allow me to introduce you to what I believe is the world's first standards based expert system for creating financial reports. This expert system is not for creating "standardized" form type reports. This expert system is for creating "customized" financial reports such as those necessary when reporting per robust financial reporting schemes such as US GAAP and IFRS. This is not a "bolt on" solution like what many other software vendors seem to have created. This is a paradigm shift. This blog post explains the difference between standardized and customized approaches.

This endeavor was achieved with the help of many, many other people over a period of about 20 years. I was the "orchestra leader" and "project manager"; the guy that pulls all the necessary pieces together.

The ultimate result is Auditchain Pacioli which is a logic/reasoning/rules/insights engine (not sure what to call it really) which was built by Miguel Calejo who has a degree in electrical engineer and PhD in computer science and has 30+ years of experience in logic programming and myself and funded by Jason Meyers of Auditchain; Auditchain Luca which is an expert system for creating financial reports which is part of the Auditchain Suite which is being created by Fuad Begic who is a full-stack developer who has been programming since he was 12 years old and myself which is also funded by Jason Meyers of Auditchain.

Auditchain Luca leverages Auditchain Pacioli's rules-based artificial intelligence capabilities. In addition, both Luca and Pacioli leverage blockchain, cryptography, cryptocurrency, and Web3.0 "stuff" that frankly I don't understand and cannot speak to.

Rather than create Luca and Pacioli to use the current substandard XBRL Taxonomies that are being created today, they are optimized to leverage XBRL-based base financial reporting scheme taxonomies that use good practices outlined by the Seattle Method, but will also tolerate existing XBRL taxonomies.

I have personally created a battery of XBRL taxonomies and reports which follow the good practices of the Seattle Method, have been tested rigorously using both Pacioli and Luca, and can be proven to be logically complete, correct, and consistent with all financial reporting metadata which is provided and represented using the global standard XBRL technical syntax, 100%. All my testing is reproducible.

A large part of the success of the creation of this expert system for creating digital financial reports is because I can "control" each of the moving pieces of the puzzle. If there is an issue or a bug with any of the software, I can talk directly with the developers and get the issue/bug resolved. I am also in control of each of the base financial reporting schemes, report models, and reports. Sure, there are other approaches that could be used; but my approach is good practices and could be used and will yield results that are as good as or better than any other approach used.

Auditchain Luca and Pacioli builds upon my work with XBRL over the years with UBmatrix where I learned a lot from Raynier van Egmond, Dean Ritz, Timothy Randle, and Cliff Binstock. In addition, work with XBRL Cloud to help them create their viewer, implement the first version of my fundamental accounting concepts continuity cross checks verification, and other such tasks/products; consulting work with 28msec where I met and learned a lot from Ghislain Fourny; about five years working with Hamed Mousavi to create Pesseract and the first desktop version of Luca; and several years working with Yury Volkovich to create the first cloud based version of Luca which supports the Seattle Method. Finally, I give Shamus Rae of Engine B the credit of introducing me to the notion of a knowledge graph. There are three accountants that I want to mention. Andrew Noble is a visionary and always has new ideas. I met Tom Egan 20 years ago in Singapore, probably one of the most knowledgeable accountants I know. Tom McKinney is also very knowledgeable, practical, and realistic. Without them I could not have succeeded.

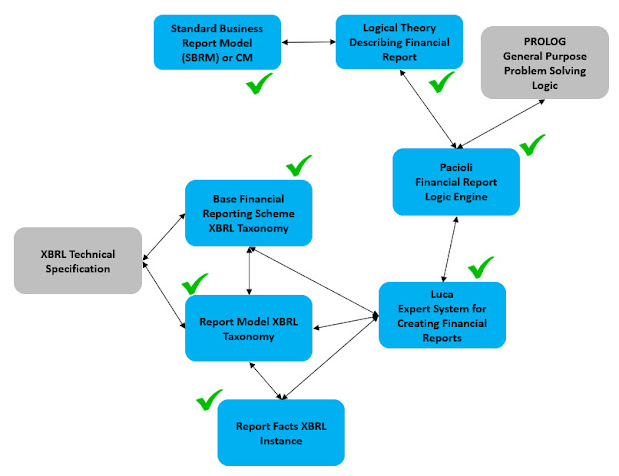

This graphic shows all of the pieces that have to be pulled together in order to make XBRL-based digital financial reporting work effectively:

The best way to understand this expert system for creating financial reports is to try it for yourself. To do that, give it one or two more months as the GUI/UX gets built out and is more approachable to business professionals. The really hard stuff is done and the core platform is dialed in. The rest is just details.

A good way to get your head around the capabilities is to watch this video playlist, World's First Standards Based Expert System for Creating Financial Reports.

If you don't understand why this is important, I would suggest reading The Great Transmutation.

For more information:

- Expert System for Creating Financial Reports Explained in Simple Terms

- Logical Scheme of Financial Reports

- Start Here

- Expert System Demonstration (Older application, desktop, but does not create report)

- How Expert Systems & Legal Document Automation Can Help Law Firms & Freelancers Stay Competitive

- GetBootstrap (Icons) (Dashboard)

- JSON LD

- Mermaid

- JavaScript Spreadsheet

- JavaScript GRID

- JavaScript Pivot Table

- Vis.js (Visualization)