Turning Accounting On It's Ear (Brainstorming)

I very well could be wrong, but I believe that I am going to turn accounting on its ear as is said. I have been trying to figure this out since about 2002 and a meeting I had in Singapore.

Stay tuned! I will lay out all the pieces for you and explain.

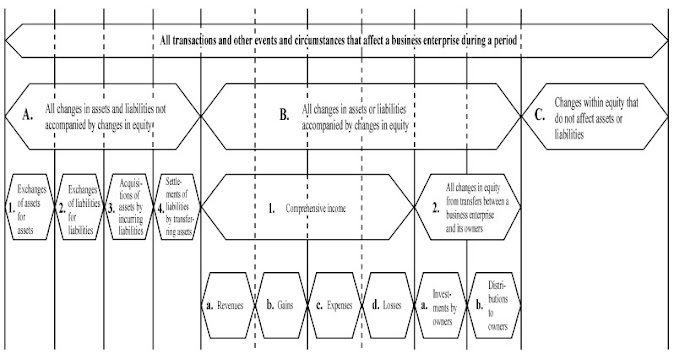

You may or may not have seen the following graphic in SFAC 6 which was published by the FASB: (see here on page 21)

What the diagram shows are the categories of "all transactions and other events and circumstances that affect a business enterprise during a period". The graphic then breaks down those transactions, events, and circumstances into categories. The categories relate to the 10 elements of a financial report that SFAC 6 defines: Assets, Liabilities, Equity, Comprehensive Income, Investments by Owners, Distributions to Owners, Revenues, Gains, Expenses, Losses.

And this graphic below is from the table of contents of the book The Joy of Accounting which is described by it's authors Peter Frampton and Mark Robilliard as "game-changing".

So, I don't know whether I should use the term "Classic Business Events" or "Classic Transactions" or some combination of those terms yet. And so, I am using both and I created TWO PROTOTYPES, one for each:

What have I done? Well, what I have done is created a prototype of six "classic transactions" of "classic business events". For each of those I:- Gave each event/transaction a specific name, for example "Acquire Inventory On Account" is one.

- I represented information about each specific event/transaction in machine readable form using global standard XBRL.

Why would I do that? Well, as Benjamin Franklin said, "An ounce of prevention is worth a pound of cure." Another way to say the same thing is the 1-10-100 rule. Put simply, the 1-10-100 rule states that it costs exponentially more to identify and correct data entry errors than to fix a system to avoid making the error in the first place. Also, if an error goes undetected it can cost exponentially more to deal with ramifications of the error.

And so why is that important? Well, because now I understand how to build an accounting system that leverages expert systems functionally to augment the skill of accountants.

For a little more background information, see this blog post Classic Transactions and Canonical Representations of Business Events.

Stay tuned! I will lay out all the pieces for you and explain.

Resources:

Uniform System of Accounts

- Restaurants

- Hospitality Industry

- Clubs

- Lodging Industry

- Mass.gov eFiling System (UFR FAQ), YouTube video, AAFCPAs

- AHACPA.org

- Church Uniform Financial Report, Example

- Foodbanks

- Not for Profit Research Foundation

- School Districts (Arizona)

- Uniform Financial Reporting for Spas

- Transportation Statistics

- Condominium Association or HOA

- Insurance Companies

- Banks

- Extractly.ai

Comments

Post a Comment