Describing Situation Semantics using Situation Theory

In the article published by the Data Foundation, Implementing the FDTA: From Data Sharing to Meaning Sharing, the authors mention the notion of the "infon" which is an idea that is defined by Situation Theory.

Situation Theory treats information as a commodity. An "infon" is a unit of information. In my Seattle Method, a "Block" of information is an infon. This is an "infon", a "block of information":

An example is provided by Situation Theory that helps one understand the utility of the theory.

Suppose that Alice and Bob were having a conversation. Alice says to Bob, “My car is dirty.” For communication to take place, a successful flow of information, then Alice and Bob need to have a shared understanding of the concept "car" and the concept "dirty".

It is not necessary that Alice and Bob share exactly the same understanding of “car” or of “dirty"; rather, what is necessary is that their understanding of “car” and of “dirty” need to sufficiently overlap. Alice and Bob need to share a common understanding of "car" and "dirty". Situation Theory helps one think through the pieces of that puzzle so that these ideas can be implemented within software applications effectively. The idea of the infons are theoretical and enable someone to analyze an information flow.

I have used the following graphic to explain this same idea. An information bearer (Alice) communicates a message ("My car is dirty.") to an information receiver (Bob). The message is an "infon".

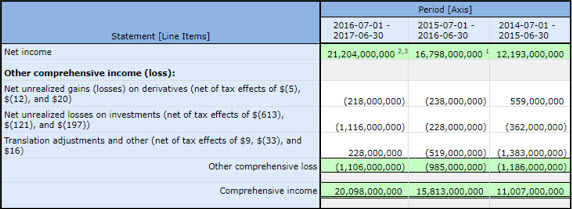

A financial report is a much more complex message, usually a set of infons. Those infons can be related to one another, for example per the financial reporting notion of articulation, and so a visualization might look something like this: (larger image)Two economic entities, A and B, each have information about their financial position and financial performance. They must communicate their information to an investor who is making investment decisions which will make use of the combined information so as to draw some conclusions. All three parties (economic entity A, economic entity B, investor) are using a common set of basic logical principles (facts, statements, deductive reasoning, inductive reasoning, abductive reasoning.), common financial reporting standard concepts and relations (i.e. US GAAP, UK GAAP, IFRS, IPSAS, etc.), and a common world view so they should be able to communicate this information fully, so that any inferences which, say, the investor draws from economic entity A's information should also be derivable by economic entity A itself using basic logical principles, common financial reporting standards (concepts and relations), and common world view; and vice versa; and similarly for the investor and economic entity B.

Comments

Post a Comment