Becoming an Expert in XBRL-based Reporting

Practice does not make perfect; perfect practice makes perfect. What I am trying to point out with that statement is that doing the wrong things over, and over, and over again to get your "10,000 hours" in does not make you an expert. Doing the right things the right way makes you an expert.

The world is pivoting, a transition is occurring. My take on that transition is articulated in my document The Great Transmutation. You can believe my view of the world or not. If you are a believer then it might seem apparent that we need more people that understand how to do XBRL-based digital financial reporting appropriately.

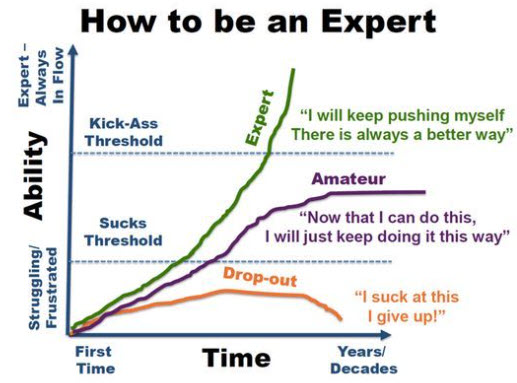

Marcus Köhnlein posted information on LinkedIn, How to become an expert, that provides general information about how to become an expert in some field and this helpful graphic:

- Identify what you're interested in.

- Focus on one task at a time.

- Start with what's most important.

- Invest time and effort.

- Set specific goals.

- Engage in deliberate practice.

- Find or create an environment for practice.

- Look for specific and accurate feedback.

- Find a mentor.

- Test yourself often.

- Focus on progression.

This is a more specific list that will help accountants and software engineers to learn about XBRL-based digital financial reporting. If you know how to do financial reporting, then you will also understand how to do general XBRL-based reporting because financial reporting is a subset of general business reporting.

So here is some good news and some bad news. The GOOD NEWS is that if you started to learn this stuff 20 years ago like I did; there was NOTHING available to help you. The technical people provided exactly one example "brand equity". Accountants had to figure out how to use these new mechanisms. The BAD NEWS is that we are not where we are eventually going to end up. Tools (software) is a bit of a problem. The software that WILL EXIST does not exist now. The software that exists today is hard to use and not adequate for the task at hand. And so, you have to make due with what is available at this point in time. Also, keep in mind that this will be an iterative process. Things will evolve.

Here is my list of what you should learn in order given the current materials and software that exists today and links to those specific resources:

- Understand the big picture: The common mistake that most people make is that they "rush to detail" and the completely miss the bigger picture. This information will provide you with a "framework" and "theory" and "method" that will help you understand the moving pieces of the puzzle, how the pieces fit together, and provide you with a solid foundation upon which to build.

- The Great Transmutation: if you did not get that you should start by reading that, I say again...start there.

- Logical Theory Describing Financial Report (terse): This document helps you look at financial reports differently; digitally.

- Essence of Accounting: Again, this is about thinking "digitally" about stuff you already understand and brings important things into your consciousness.

- Seattle Method: This documents a proven, industrial strength approach to thinking about and working with XBRL-based digital reports.

- Special Purpose Logical Spreadsheet for Accountants: Helps one see the application of XBRL-based reporting beyond financial reports.

- Get the best tools that you can: Some people don't have a big budget (or any budget). Well, do you REALLY want to be an expert? You have two choices: (a) fork out some money or (b) struggle with what you can get on the cheap. Here is some free to use software

- Auditchain Suite (specifically Luca): Pretty good learning tool, but the software is not yet complete and it has some flaws.

- Auditchain Pacioli: This is excellent software, you can learn a LOT about the reality of XBRL-based reporting; but it is on the technical side and the primary function is the verification of reports; you cannot really use this tool to create reports...but you can use the tool to see how good what you created is.

- Pesseract: This software has an excellent GUI/UX, but it is a desktop application in a cloud based world that needs to be installed and it can only be used to VIEW and VERIFY reports; you cannot create reports with the tool. But this is a very good working proof of concept that can be used to learn about XBRL-based reporting.

- General Luca: Free (currently) cloud based tool; you need to have some imagination to make effective use of it in its current state.

- Arelle (free open source XBRL processor): Arelle is pretty good, but a technical level tool that can be very hard to use. But it is useful.

- Get your hands dirty by building reports: Next you will want to get your hands dirty and build some reports. Start small, then create increasingly complex reports. Remember, you want to understand how to build reports CORRECTLY. Remember; perfect practice makes perfect.

- Very basic XBRL primer: In this very basic XBRL primer you will create a "Hello World!" report. You can dig into the XBRL technical syntax if you want, that information is provided, or you can skip that technical level of detail.

- Accounting equation: This is about as basic as it gets.

- SFAC 6: Adds the notion of "structures"

- SFAC 8: Adds notion of "models".

- Common Elements of Financial Report: Looks increasingly like a real financial report; but still fairly basic.

- MINI Financial Reporting Scheme: This looks like a real financial report, but it is still basic in terms of complexity.

- PROOF: Introduces more complexity.

- AASB 1060 Financial Reporting Scheme: This is a real financial reporting scheme, but only about 20% of the reporting scheme is provided for. But, what does exist is extremely high quality.

- Reverse engineer what others have done: Once you understand some basic ideas and can tell fundamentally good things from bad things; start exploring real XBRL-based reports that others have created.

- Business Use Cases and Test Cases: This is a set of about 70 small, focused fragments of what you might find in an XBRL-based report. Every XBRL-based report is made up of the same "patterns" that you see in these examples. These are very high quality examples of GOOD and a few BAD report fragments.

- DOW 30: This is a list of XBRL-based reports submitted to the SEC by 30 big companies and explanations of errors that exist in the reports.

- Fortune 100: This is a list of XBRL-based reports submitted to the SEC by 100 of the biggest companies.

- Consolidate your knowledge: Once you have been through all of the stuff above; now you can consolidate your knowledge.

- Essentials of XBRL-based Digital Financial Reporting: Summarizes the most important aspects of XBRL-based reports that most people tend to miss.

- Mastering XBRL-based Digital Financial Reporting: This is probably the best set of resources related to understanding XBRL-based reports that exists today. (If you find something better, please let me know).

- Rules of Thumb: This is pretty advanced stuff. But if you waded through the material above, you will find this very useful.

- XBRL: Simple, Precise, Technical: This is an excellent book, the FIFTH EDITION. If you want to understand the technical details, knock yourself out!

- My Newest Blog: This is my new blog with the most current information.

- My Lab Notebook (Old Blog): This is my older blog, basically a lab notebook that I keep as I learned about XBRL. It is a treasure trove of information; but there is a lot there. Most of the best information has made it into the "Mastering" document. But if you want to understand my train of thought, there you go.

Comments

Post a Comment