Zen of XBRL-based Digital Financial Reporting

Zen is a philosophy or a way of being based on a sense of having awareness and mindfulness. To me, Zen is about elegance, grace, and beauty.

A general purpose financial statement tells a story. A general-purpose financial statement is a true and fair representation of information about an economic entity following an agreed upon set of basic accounting principles. A financial statement is not the actual economic entity, it merely conveys fairly high-fidelity information about an economic entity that is generally of very high-quality.

Consider the term "statement". A statement is a declarative sentence. A statement declares information. In logic and semantics, the term statement is understood to mean either: a meaningful declarative sentence that is true or false, or a proposition that asserts that something is true or false.

Logic is a formal system that defines the rules of correct reasoning about logical statements. Logical reasoning is about arriving at a conclusion in a rigorous way.

In the past, people would reason about the statements provided within a general purpose financial report. Today, people can still reason about those statements but also machines can reason about those statements provided within a general purpose financial statement.

The story which is communicated by the declarative logical statements within a general purpose financial statement does not change based on the medium used to tell that story. Whether the logical statement is etched into a clay tablet, typed onto a piece of paper, printed to PDF, or represented using XBRL; the meaning of the information is the same, or should be the same, regardless of the medium used to convey that information.

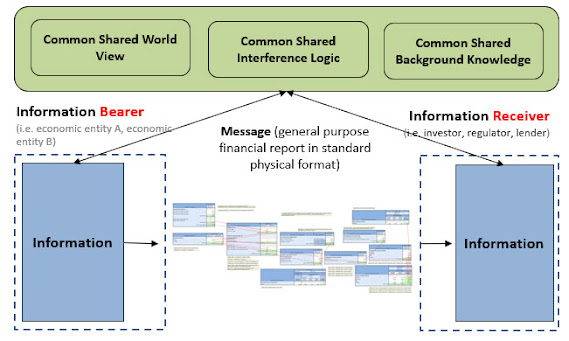

The meaning conveyed by the financial information articulated by the creator of the financial statement and the meaning of the financial information derived by the users of the financial statement should be the same. Both the information bearer (a.k.a. economic entity creating the financial statement) and the information receiver (a.k.a. a financial analyst, investor, regulator, etc.) should walk away with the same message or story. Information bearers (creators of financial statements) go to great lengths to tell the story, or convey meaning, which they believe best reflects the financial status and change in financial status of the reporting economic entity providing the financial statement. Consider the following use case of a general-purpose financial statement:

Two economic entities, A and B, each have information about their financial status (a.k.a. financial position) and change in financial status (a.k.a. financial performance). They must communicate their information to an investor who is making investment decisions which will make use of the combined information so as to draw some conclusions. All three parties (economic entity A, economic entity B, investor) are using a common set of basic logical principles (facts, statements, deductive reasoning, inductive reasoning, etc.), common financial reporting standard concepts and relations (i.e. US GAAP, UK GAAP, IFRS, IPSAS, etc.), and a common world view so they should be able to communicate this information fully, so that any inferences which, say, the investor draws from economic entity A's information should also be derivable by economic entity A itself using basic logical principles, common financial reporting standards (concepts and relations), and common world view; and vice versa; and similarly for the investor and economic entity B.

Creators and users of a financial statements are free to interpret the information communicated by the message/story of that financial report as they see fit. But, the information itself, the facts, should be identical for both the information bearer (creator of statements) and information receiver (user of statements).

Reported information are logical statements. A reported fact is a type of logical statement. For example, if a fact is reported and the fact is deemed to relate to the consolidated entity, be as of December 31, 2019, for the US GAAP concept “Cash and cash equivalents”, being expressed in US dollars; then the meaning of the fact should not be in dispute between two different parties who are using the same piece of financial information. However, any party is free to interpret the facts as they deem appropriate.

A general purpose financial statement is a knowledge graph. That financial statement knowledge graph is a system and that system is in effect “blind” to things not covered by the rules of that system. The system should be complete, precise, and consistent.

A knowledge graph is a representation approach that stores logical statements, such as those logical statements contained within a general purpose financial statement, in machine-readable and machine-understandable form.

Using a machine-understandable knowledge graph represented using a global standard technical syntax such as XBRL; it is possible to describe well understood and agreed upon quantitative and qualitative associations between financial facts or sets/assemblies of financial facts within a financial statement, more granular information in accounting working papers or audit schedules, or even non-financial information. Such associations can have any degree of complexity or granularity, without sacrificing accuracy or nuance.

Effectively, a machine can read that knowledge representation and then mimic understanding of that knowledge represented in a knowledge graph and the information available to both a human reader and a machine reader would be the same and therefore the human and machine should reach the same conclusion.

Prudence dictates that using information from an XBRL-based general purpose financial report should not be a guessing game. A system is in effect “blind” to things not covered by that systems rules. An incomplete set of statements, an imprecise set of statements, or inconsistent/contradictory statements make a system unreliable.

The Seattle Method provides guidance related to creating provably correct (complete, precise, consistent) XBRL-based general purpose financial statements.

Additional Information:

- Elements of Financial Statements (FASB, CON 6)

- Standards Based Logical Twins Terminology

- Puzzle Pieces of Digital Financial Reporting

- Essence of Accounting

- Professional Accountant’s Interests, Perspective, Position, and Risks

- Logical English

- XULE

- Surfaces and Essences

- Digital Financial Reporting (IFRS Foundation)

Comments

Post a Comment