Puzzle Pieces of Digital Financial Reporting

I have been thinking about XBRL-based digital financial reporting now for about 20 years. I collected a lot of really good information and put it into a document, Essence of Accounting.

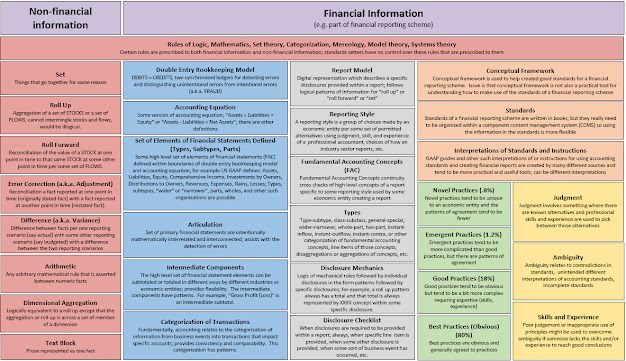

I was trying to explain how financial reporting worked to to someone the other day and I through a lot of "stuff" and I put that stuff on a piece of paper. To better think through this, I put the information into PowerPoint, and organized it as a very rudimentary infographic. Here is the result of that brainstorming: (here is a JPEG of that graphic)

The organization above did not get me where I wanted to go, so I reorganized the information above into this "flow" which I think is better:

That is perhaps a bit hard to understand, so here is a narrative that tries to explain what I am trying to get across:- Math and Logic (in red): Fundamentally, financial reporting is grounded in the rules of mathematics and logic. The rules of mathematics and logic precede any rules that standards setters establish.

- Financial Information (in blue): Financial reporting schemes represent a lot of non-financial information; but they also have a special category of information referred to as "financial information". The differentiating characteristic of financial information as contrast to non-financial information is the fact that financial information runs through the trial balance of an accounting system. "Accounting" is a specialized tool. Accounting is a universal technology of accountability. Financial accounting has these special characteristics:

- Double-entry bookkeeping model (a mathematical model)

- Accounting equation

- Elements of financial statements (provides details which breakdown the elements of the accounting equation). This includes types, subtypes, parts.

- Articulation which is the notion that the financial statements are intentionally interrelated mathematically.

- Intermediate components which is the notion that lower level financial line items can be totaled and subtotaled in different permitted ways (not randomly)

- Categorization of transitions, the point of all this accounting stuff is to provide standardized categorizations of the information from business events that end up as the transitions in an accounting system of an economic entity so that they can be used to create financial reports

- Conceptual Framework, Standards, Interpretations and Instructions (in orange): A conceptual framework as created today helps standards setters set standards. The standards tend to be written in books and some of those books have been transferred to rudimentary content management systems. Standards tend to be hard to read, even for the average professional accountant. So, interpretations of the standards are created that are more practical. Instructions are also created. The thing is, all this documentation tends to not be interlinked; the information reflects "strings", not "things". But what if it did represent "things"? Think "ontology" and "rules" and "knowledge graph".

- Sensemaking (in green): Sensemaking is the process of determining the deeper meaning or significance or essence of the collective experience for those within an area of knowledge. One needs to be in agreement as to an undisputed core of a system. The Cynefin Framework provides a tool for understanding knowledge:

- Best practice (obvious)

- Good practice (only obvious if you have the right skills and experience)

- Emergent practice (tend to have to have more skills and experience, then can use principles to group alternatives)

- Novel practice (tends to unique, but describable)

- Complexity: There are different types of inherent complexity and by distinguishing between the different types one can better understand a system: (accidental complexity should always be removed from a system)

- Organized simplicity

- Unorganized complexity

- Organized complexity

- Making Choices (in yellow): Accountants make choices and sometimes the confuse what is driving the choice they make or why they have to make that choice:

- Judgement; not every choice relates to "professional judgement"; picking between permitted alternatives using their skills and experience

- Ambiguity; unintended ambiguity exists in accounting standards, just as ambiguity tends to exist in pretty much everything humans create; this is why the tax code grows, and grows, and grows...

- Skills and experience; not every accountant has the same level of skill and experience in every practice area of financial accounting or reporting; most accountants are average; not ever disclosure created in a financial report is an "art project"; less than 10% tends to be the art, 90% tends to be straight forward, mechanical, rote.

- Digital artifacts (in gray): If you care going to digitize something, it needs to be done right and it needs to be complete. The system needs to be reliable. Here is the stuff that needs to be digitized:

- Report model logic definition

- Reporting styles need to be considered

- High level financial reporting concepts so you can perform cross checks to detect unintended errors

- Type-subtype, class-subclass, general-special, wider-narrower, part-whole and other such relationships; need to control report model modifications to keep the modifications within permitted boundaries

- Mechanical aspects of representing disclosures to make sure the disclosures are represented correctly

- Checklists of rules that help a report creator understand it they put all the pieces in the report that they should have included.

Think of the above as examples of what is NECESSARY. Is the above sufficient? Maybe, maybe not. But I can tell you this with certainty. Today, XBRL-based digital financial reporting is fragile, brittle, and therefore wrought with errors; which causes unreliable information and therefore the utility of what XBRL-based reports delivers is not what it needs to be. Tomorrow, XBRL-based reporting will be robust, resilient and therefore quality will be within the required range; and therefore information will be reliable; and therefore it will be useful. Someone will put the pieces together effectively. What you see above is an important summary of the puzzle pieces.

All of these pieces can be explained using something like a theory, an ontology, or a taxonomy:

Eventually, this information will be put into a taxonomy.

Additional Information:

Comments

Post a Comment