Becoming an XBRL-based Digital Financial Reporting Master Craftsman

Personally, I knew XBRL-based digital financial reporting was going to be important in 1998. Honestly, I did not realize how important; I gained that understanding later.

Now, everyone and their brother/sister seems to be increasingly interested in XBRL-based reporting.

Today, you have a bunch of people that call themselves "XBRL reporting experts". And they are experts; but experts in the creation of XBRL-based reports that have serious flaws. You get what you do.

Rather than going down the goat path that others went down; I took a different path. I spent 20 years trying to figure out how to do XBRL-based financial reporting right. Practice does not make perfect. Perfect practice makes perfect. During my journey to understanding XBRL-based financial reporting I maintained a blog which was, in essence, my lab notebook. Every now and then, I synthesized what I had learned into Mastering XBRL-based Digital Financial Reporting. If I were to have to point you to one document to start your journey; start with Essentials of XBRL-based Digital Financial Reporting.

That information needs more reworking for general consumption. But a motivated individual can gain a lot from wading through that information. I am not going to spend a lot of time reworking that information above. I am going to do something better. What I am going to do is get the right software created which will make most of the above information unnecessary for the average professional accountant.

What most others have created in terms of XBRL-based financial reporting software can best be described as a kludge. The software tends to be able to meet a regulator mandate. People don't really want to use that software, they have to use that software in order to meet a regulator mandate. Those XBRL-based reports submitted to regulators tend to have far too many logical flaws. Most XBRL-based reporting systems are "bolt on" additions to existing inefficient reporting systems.

A kludge is an engineering/computer science term that defines what is best described as a workaround or quick-and-dirty solution that is typically clumsy, inelegant, inefficient, difficult to extend and hard to maintain; but it gets the job done. The nautical term we used in the U.S. Coast Guard (I served as a boatswain's mate) for this is "jury rig".

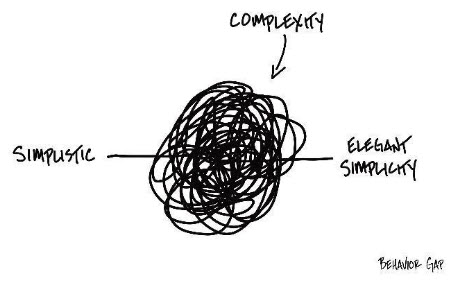

By contrast, elegant software appears graceful and beautiful and shows unusual effectiveness and simplicity. But the path to simplicity passes through complexity.

I am not trying to create something "simplistic". Simplistic is about dumbing something down to make it easier. As I describe in my blog post Problem Solving Systems, this is about embracing the notion of irreducible complexity, embracing the Law of Conservation of Complexity, avoiding accidental complexity, and creating something that is elegant simplicity instantiated.My objective is to do for financial reporting what Steve Jobs did for the mobile phone. Steve Jobs did not build a better mobile phone, he created the smart phone. Today, what people call "the last mile" of financial reporting is a kludge that can be rethought. By applying technology; Lean Six Sigma philosophies, principles, and techniques; creativity; and cleverness; then financial accounting, reporting, auditing, and analysis can be both way more fun and professional accountants can do more rewarding and value add work than "Copy, Paste, Adjust".

It is my intention to do for financial reporting what Intuit's TurboTax did for creating income tax returns, times 100. This is not about just creating a software application; this is about creating an entire integrated system. An ecosystem in which friction is reduced or maybe even eliminated and accountants can do accounting, not uninteresting repetitive janitorial work. This system will evolve over the next 100 or even 500 years.

Creeping normalcy got us where we are today. Most organizations are not remotely ready for leveraging artificial intelligence, their systems are hairballs. This is not about trying to improve the existing paradigm; this is about creating a new paradigm.

Comments

Post a Comment